does personal cash app report to irs

However in January the. This story is part of Taxes 2022 CNETs coverage of the best.

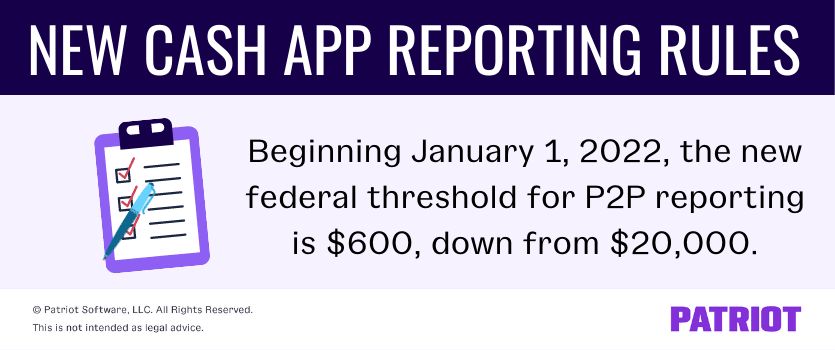

Changes To Cash App Reporting Threshold Paypal Venmo More

KERO The IRS has designed new ways of taxing cash app transactions but misconceptions might be leaving some confused about who these changes apply to.

. In most cases you will report this income on a Schedule C filed with Form 1040. Starting in 2022 mobile payment apps like venmo paypal cash app and zelle are required to report business transactions totaling more than 600 per year to the irs. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS.

Depending on the structure of your business many forms could be employed. Starting this year. IRS Form 1099-B is the general form you fill out if youve been making money on general transactions or brokerages.

The American Rescue Plan includes a new law that requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. New IRS rules for cash app transactions take effect in 2022 Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a.

A person must report cash of more than 10000 they received. You might be wondering. Make sure you fill that form out correctly and submit it on time.

Does Cash App Report Personal Accounts To Irs. Personal Cash App accounts are exempt from the new 600 reporting rule. Reporting Cash App Income If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year.

CPA Kemberley Washington explains what you need to know. Cash App is required by law to file a copy of the Form 1099-BK to the IRS for the applicable tax year. Many people have wondered whether their cash app pays taxes.

If you make more than 600 through digital payment apps in 2022 it will be reported to the IRS. Does a Personal Cash App report to the IRS. It is a common scenario particularly when members of a household split bills.

This is far below the previous threshold of 20K. Does Personal Cash App Report to IRS. There are many queries of.

Reporting Income from Cash Apps For transactions that took place in the 2022 tax year you will receive a 1099-K in 2023 if you receive more than 600 using cash apps. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. Personal Cash App accounts are exempt from the new 600 reporting rule.

Previous rules for third-party payment systems required them to report gross earnings over 20k or if the user had a total of more than 200 different transactions in a fiscal year. The answer to that question depends on your circumstances and your taxes. The forms used may differ based on your business structure.

You will often include a Schedule C with your Form 1040 to disclose this income. Previous rules for third-party payment systems required them to report gross earnings over. You May Owe the IRS Money Next Year.

Is your cash app not working. As of Jan. Certain Cash App accounts will receive tax forms for the 2018 tax year.

Does the cash app report personal accounts to IRS. Starting January 1 2022. Does Cash App Report To Irs For Personal Use - inspire.

Any errors in information will hinder the direct deposit process. The american rescue plan includes a new law that requires cash apps like venmo and cash app to report payments of 600 or more to. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain payment transactions that met.

As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS. In one lump sum In two or more related payments within 24 hours As part of a single transaction within 12 months As part of two or more related transactions within 12 months When to file A person must file Form 8300 within 15 days after the date they received the cash. Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules Cash App wont report any of your personal transactions to the IRS.

The change to the. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. Nothing to do with the transfer method currency etc.

This new 600 reporting requirement does not apply to personal Cash App accounts. Want to see the transaction history. A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account.

Want assistance in solving cash app related woes. The answer is very simple.

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Are Biden And Dems Planning To Spy On Bank And Cash App Accounts Snopes Com

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report Personal Accounts To Irs Rules Change Explained

Reporting 600 Cash App Transaction To The Irs New Tax Law Explained Answering Questions Youtube

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

The Irs Is Clamping Down On Cash Apps Could This Affect Your Rental Business

Irs Has New Ways Of Taxing Cash App Transactions

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

What Cash App Users Need To Know About New Tax Form Proposals Cbs8 Com

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Tax Reporting With Cash For Business

Changes To Cash App Reporting Threshold Paypal Venmo More

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff